Spending money can almost be as stressful as not having any. Read more about how to use it for yourself without the guilt

Spending Money on Fun

Check out our budgeting, saving, and general money tips – in a language we can all understand.

Spending money can almost be as stressful as not having any. Read more about how to use it for yourself without the guilt

Contributed by: Omaira Gonzalez, COO of Family Bridges Have you ever heard the term “keeping up with the Joneses?” It’s where individuals want to keep up …

What to do when someone pretends to be you. Explaining how to take back your life after identity theft.

If you’re struggling financially, the last thing you need is a hefty medical bill making things 10 times worse. Did you know there are ways you can get that bill lowered?

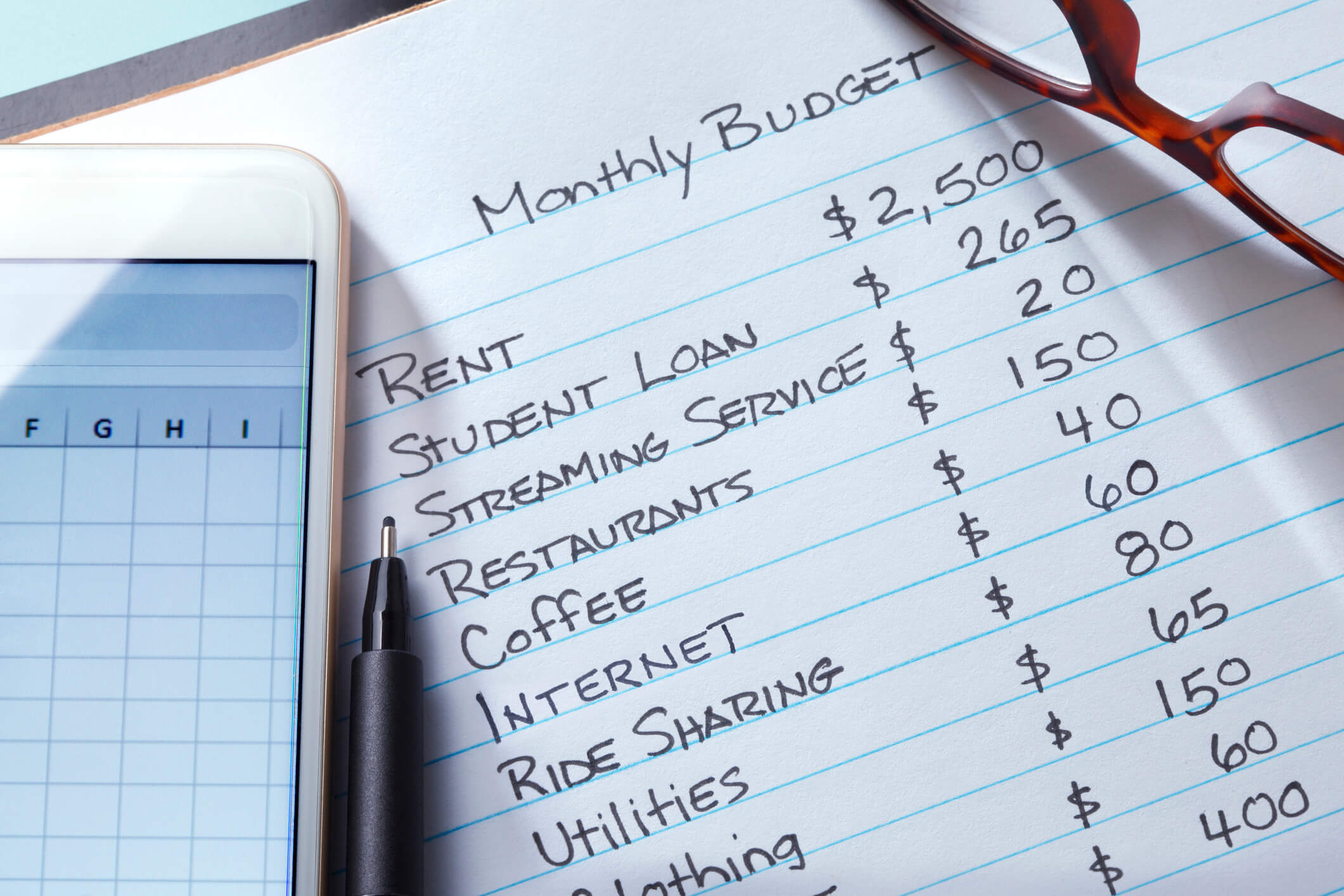

Many Americans are receiving their third stimulus check, here are 10 ideas to help make the most of your stimulus check.

College is expensive. Even those who chose to go an alternative route like community college or technical school can face thousands of dollars of cost. …

If you play your cards right, finding scholarships for college can take a huge load off the financial burden of secondary education. Whether you are …

It’s important to think about retirement when you are young. All the savings options can be so confusing, so we’ve broken it down here.

Decorating can be expensive, but you can have your dream decor without spending a million dollars. Here are 10 tips for decorating on a budget.

Student loans can be stressful to talk about, especially at first when everyone is throwing around big words you’ve never heard before. So here is a brief breakdown of those fancy words and what they can mean for your future.

Understanding your paycheck is the first step in financial literacy, and with that comes an easier time with money management.

Stop throwing your money away, you’ve got to pay off debt and buy a new pair of shoes. Here are five things you should cancel, stop buying and start doing to help you save some of your hard earned money.

Do you lay awake at night wondering if a purchase is worth it? Like do you really need it or is it going to make …

The holidays can be stressful. Money can be tight for some. We all have different habits regarding money, but we can generally categorize people into …

I’m not going to lie. For most of my life, my mom made really good money. I went to private school since I was 4. …

My credit card helped saved my life. (I’m being dramatic.) For thanksgiving, my sophomore year of college, my friend Dustin and I went to Virginia. …

Good credit will get you a loan for a car, house, or better deals on insurance, or even let you rent an apartment. Building credit is easy. Pay your bill on time and in full every month. The key to building good credit is getting into good habits early on and sticking to them.