“Save money, and don’t buy Starbucks every day.” is the biggest load of financial advice crap someone can give. The only way to save money is never to leave your apartment because none of us can afford to own a house and do absolutely nothing with our lives. Do you want to have fun? Fun is for those who have money. How dare those of us who are broke try to treat ourselves to a simple hot cup of serotonin.

My go-to order is a venti latte because if I’m going to spend money on a cup of coffee, it might as well be the biggest one they offer. My order costs about $4, which isn’t too bad, but buying one every day would add up to $1,460 a year. And that’s if I go every single day. At one point, I was. There was a Starbucks on the bottom floor of my apartment building. It has since moved to a new location, but it’s so easy to spend four or five dollars a day without thinking about it, especially if the money spent sparks some joy on a wet and miserable Portland winter morning.

But I swear if I hear one more person say that buying a cup of coffee at Starbucks is a waste of money and I could save so much money if I just made a cup at home. I might lose my mind. I barely have any money after I pay my rent, utilities, insurance, and groceries, so excuse me if I want to treat myself to a simple cup of coffee. Life is a lot more expensive nowadays than forty years ago so maybe keep your “daily savings tips” to yourself.

(Is that too mean? Probably, but so it chastising me for buying a cup of coffee every once in a while. Inflation kills any hope of me ever buying anything worth owning.)

Daily savings tips from a fellow zillenial

Acorns

I would be lying if I said this wasn’t the sneakiest way to save money. Someone understood how Gen Zers function and created an investing app for us. (No, Acorns is not sponsoring us.) But it’s one of those things that I set up forever ago and forgot about. It sits in my financial app folder on my phone since I avoid looking at that folder with all my heart. (My anxiety can’t take it. I could know I have no credit card debt, and there is money in my account, and still my heart rate spikes.) I simply forget that money is slowly added to my Acorns account every time I purchase something.

Am I saving a lot of money using this method? Not, but it has come in clutch more often than not. You know those moments where you are truly and utterly broke, where you went couch cushion diving to find spare change to get your account out of the red until you get paid again. (Damn those overdraft fees.) In those dire moments, or when my dog gets sick and needs medicine, I check my Acorns account. In six months or so, I can get a couple hundred bucks just sitting there. It’s easy to set up and comes in clutch when it counts.

Venmo

I treat Venmo the same way I treat forgotten or lost money. You know when you find a twenty-dollar bill in your jeans on laundry day, and you get super excited because it’s free money? I treat Venmo the same way. That’s to say that I just let any money in my account just sit in there out of sight. (Yes, I am very much aware that I can have my money work for me if I invest it. Thanks for the advice, finance bro, but this isn’t the point.) My Venmo account is like a not-so-secret but still secret savings account.

My friends and I are pretty lax about splitting lunch bills and stuff. If one of us beaks up the tab, we just round up to the nearest dollar what we owe each other. There is no reason to get in a fit about something as dumb as forty-five cents. So if I pick up the lunch tab and they Venmo me what they owe, then the money just sort of sits there until I need it or I come up with an idea for it. (Yes, that includes investing it.)

There are probably some older Millennials and Gen Xers who are cringing at the idea of using Venmo as a faux savings account, but I’m ADHD and have the worst spending habits ever. Out of sight, out of mind is best for me. Think of it as the virtual version of the envelope system that Dave Ramsey taught your generations. (here’s an explanation for those who haven’t been indoctrinated by the Dave Ramsey school of finance.)

But don’t let too much money sit in here because at the end of the day, it’s not FDIC insured. Meaning. If somebody hacks your account, that money isn’t insured, so you can kiss it bye-bye.

Saving and Budgets

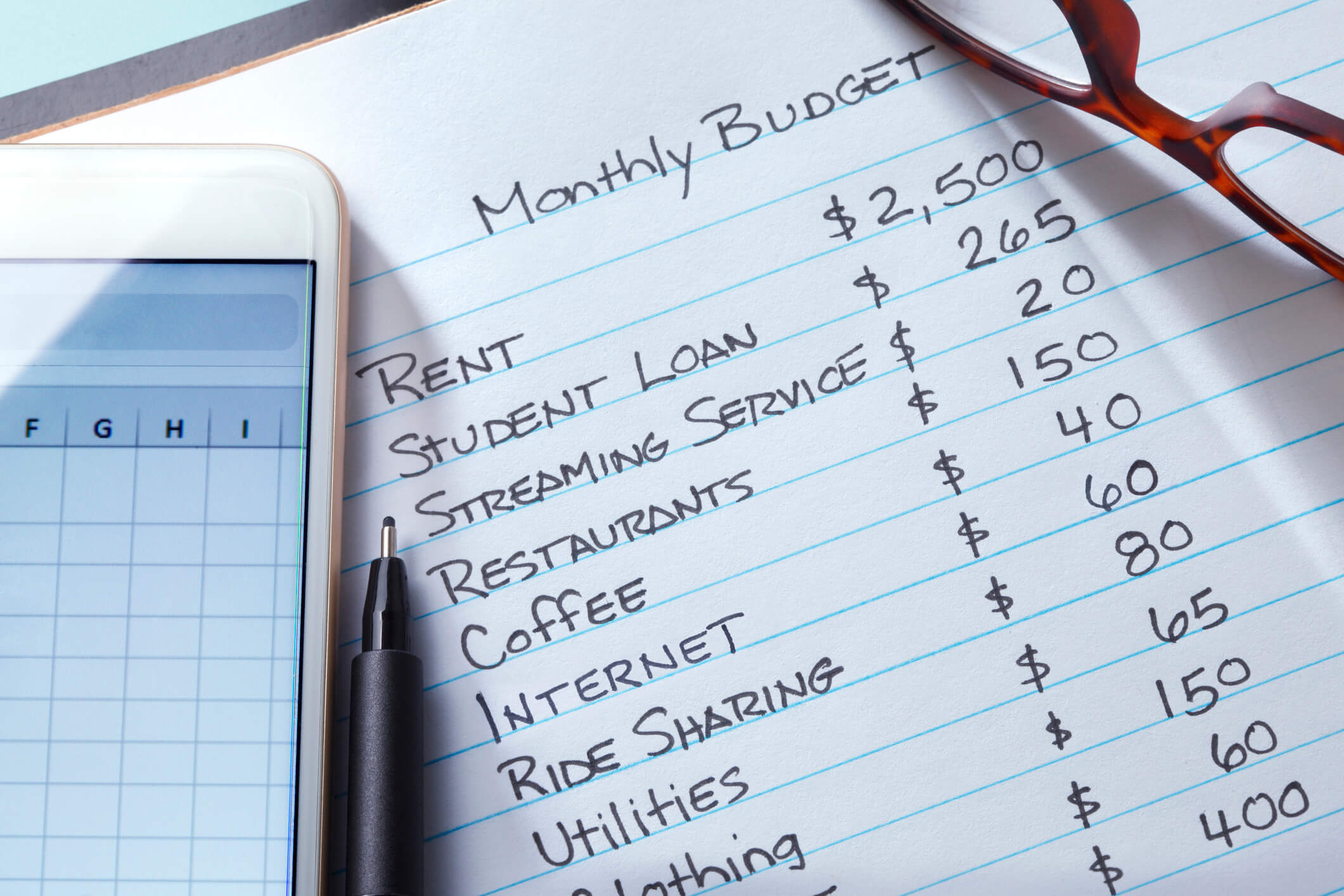

I don’t know if it’s because I barely view myself as an adult or if inflation sucks right now and everything is overpriced, but it feels impossible to save money. Or at least impossible to save money without locking yourself away in your apartment and throwing away the key. Unlike generations before, we have Amazon and the internet shopping temptations to fight off. Whatever it may be, it feels impossible, but find a system or app or weird, quirky thing that works for you. And for the love of everything good in the universe, make a budget and see where you are spending more money than you should.

[…] We can separate life into a few categories. We do it here on Everyday Owl for content all of the time. Your life consists of relationships, your job/career, your health, and money. Don’t get me wrong, other things in our lives make it great, but I’m only going to talk about these broad categories, except for money. (We already did that one.) […]